Problem

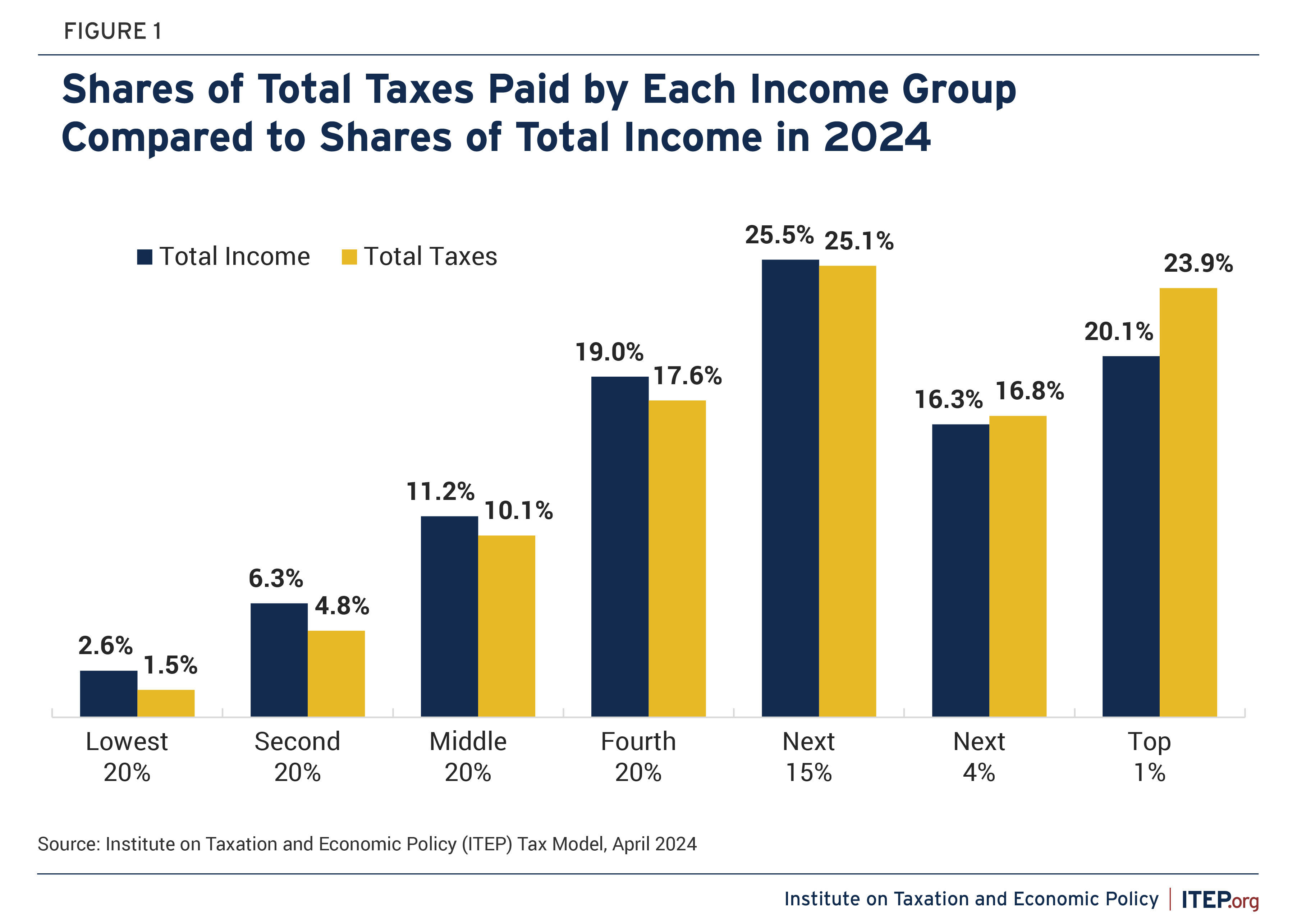

The U.S. tax code is needlessly complicated, and inherently unfair. Because the government is captured by capital, the tax code provides a variety of loopholes for the wealthiest in society. Through offshore tax havens, trusts, exemptions for paying capital gains tax, company income tax, and a variety of other streams of revenue, wealth inequalities grow deeper and deeper as smaller and smaller funds serve the majority of the population. The middle class bears the largest brunt of taxes, which has been consistently eroded for the past half century.

Solution

The 38th Amendment defines six major tax forms, establishes initial rates (that can be modified only to a degree by the legislature), and simplifies the tax system by (a) abolishing taxes for businesses (which are now owned by workers; see 33rd Amendment: Socio-Economic Reform), (b) using gross instead of next income for estimates, and (c) uses multiples of averages to calculate tax brackets instead of fixed rates that have to be continually revised. The Amendment also prohibits the varieties of tax evasion that are currently normalized, and requires business balance sheets and cashflow statements to be publicly and annually disclosed.

The Text of the 38th Amendment

Section 1. Taxes

The government of federal, state, and local levels shall primarily be funded through the following taxes: (1) income tax on gross individual income (with rates based on multiples of the average individual gross income); (2) property tax (paid according to end of year or last average quarterly cash [whichever is greater] value with rates based on multiples of the average individual net worth); (3) inheritance tax (paid according to end of year or last average quarterly cash value [whichever is greater] with rates based on multiples of the average individual net worth); (4) sales tax (fixed at 6% for the federal level, subject to legislative modifications; see Section 4); (5) import taxes (tariffs and duties); (6) tourist/visitor taxes. Businesses and organizations shall not be directly taxed.

Section 2. Prohibition of Hiding Income or Property

It is prohibited for individuals to avoid paying taxes by using company assets for their personal use, using shell companies, spurious names or entities, trusts or foundations, offshore tax havens, laundering money, or conducting other such evasions. Any citizen or permanent resident that allocates or systematically transfers more than half of their wealth or their company’s wealth (or their company’s company’s wealth…) to accounts not located in the United States for any reason other than establishing foreign residence shall be liable for violating this Section. (Restated Section 3, 34th Amendment)

Section 3. Public Disclosure of Business Cashflow and Balance Sheets

All businesses operating within the jurisdiction of the United States, regardless of size or type, shall be required to publicly disclose their cash flow statements and balance sheets on an annual basis. Exceptions to this mandate may be granted only by federal legislation under strict and justified circumstances to protect national security or individual privacy.

Section 4. Tax Brackets

Baseline tax rates are established in the table below. The People’s House may adjust the rates in this table by no more than fifty percent (50%) of their current values. State and local tax rates shall be determined by their own governments with averages based on state and local figures respectively; however, state and local governments must not exceed half of the federal rates. Import and export taxes may not exceed 12%. Foreign tourist/visitor taxes, which are a one-time entrance fee required for a party of foreigners, numbering 1 (1) to six (6) persons and traveling to the United States, apply at daily, weekly, or monthly rates depending on the traveler’s length of stay. Tax credit legislation meant to alleviate tax burdens on certain groups may only be offered to those in the lowest three (3) tax brackets (A, B, and C).

|

Income Tax |

||||

| Multiple of Average Individual Gross Income | Federal Tax Rate | State Tax Rate | Local Tax Rate | |

| A. | .1x-.29x | 0% | 0% | 0% |

| B. | .3x-.99x | 6% | ≤3% | ≤3% |

| C. | 1x-2.99x | 12% | ≤6% | ≤6% |

| D. | 3x-9.99x | 18% | ≤9% | ≤9% |

| E. | 10x-99x | 24% | ≤12% | ≤12% |

| F. | 100x and higher | 36% for income amounts at 100x and 100% on amounts beyond 100x | ≤18% | ≤18% |

|

Property Tax |

||||

| Multiple of Average

Individual Net Worth |

Federal Tax Rate | State Tax Rate | Local Tax Rate | |

| A. | .1x-.29x | 0% | 0% | 0% |

| B. | .3x-.99x | 1% | ≤.5% | ≤.5% |

| C. | 1x-2.99x | 2% | ≤1% | ≤1% |

| D. | 3x-9.99x | 6% | ≤3% | ≤3% |

| E. | 10x-99x | 12% | ≤6% | ≤6% |

| F. | 100x and higher | 24% on property(s) amounts at 100x and 100% on all amounts beyond 100x | ≤12% | ≤12% |

|

Inheritance Tax |

||||

| Multiple of Average

Individual Net Worth |

Federal Tax Rate | State Tax Rate | Local Tax Rate | |

| A. | .1x-.29x | 0% | 0% | 0% |

| B. | .3x-.99x | 2% | ≤1% | ≤1% |

| C. | 1x-2.99x | 3% | ≤1.5% | ≤1.5% |

| D. | 3x-9.99x | 6% | ≤3% | ≤3% |

| E. | 10x-99x | 12% | ≤6% | ≤6% |

| F. | 100x and higher | 24% | ≤12% | ≤12% |

|

Sales Tax |

||||

| Federal Tax Rate | State Tax Rate | Local Tax Rate | ||

| 6% | ≤3% | ≤3% | ||

|

Import Taxes (Tariffs) |

||||

| 0-12% | ||||

|

Tourist/Visitor Tax |

||||

| Per Party (1-6 persons) | Daily Rate | Weekly Rate | Monthly Rate | |

| (Percent of Average American Individual Gross Income) | ≤.01% | ≤.1% | ≤.5% | |

| (Example: $100,000) | (E.g., $10) | (E.g., $100) | (E.g., $500) | |

Section 5. Schedule of Implementation

This Amendment shall come into effect no later than eighteen months (18) after approval. This Amendment abolishes all prior taxes for all levels of government. Should the forms of taxation in this Amendment be inadequate for government funding, additional forms of taxation not addressed in this Amendment may be passed by legislation after approval of this Amendment.