Problem

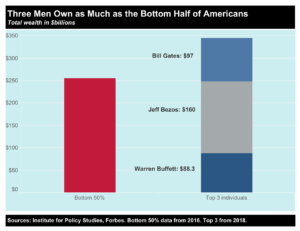

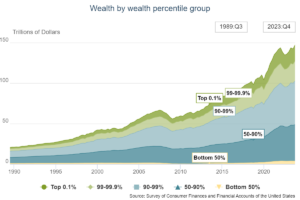

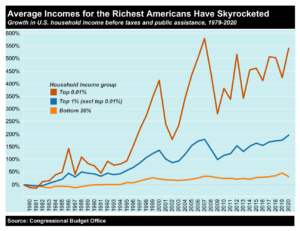

Wealth inequality is a massive problem in the world today, especially in countries like the United States. Concentrations of economic and financial power undermine the integrity of elections, squash the freedoms of individuals and creative minds, create incentives for violence and war, waste precious resources, foster social injustices, and needlessly destroy the earth and environment on which we all depend.

Debt traps, compound interest, and other mechanisms are also a major problem, which push ordinary people in financial slavery. Meanwhile, the financial sector is replete with corruption, financial scams and pyramid schemes, and investment vehicles that drain the real economy of resources and funnel them to the very top of society. Absentee landlording monopolizes the housing market, raises housing costs, and creates more wealth inequality. The Federal Reserve bank encourages unlimited debt, operates undemocratically, marginalizes member-owned financial institutions, and benefits the financial sector more than the public at large. The government is also not required to have long-term budgets (balanced or otherwise), which encourages reckless government spending. Nothing is preventing the Great Recession (2007-2008), or something worse, from happening again.

Solution

The 34th Amendment establishes clear rules for wealth and income limits in all of their basic forms. Besides placing a fixed ceiling on personal wealth and income, it limits definitions of property (including intellectual property), prohibits financial scams and harmful practices, and brings an end to absentee landlording. It also replaces the Federal Reserve system with a new monetary regime based on better principles and practices, and also requires the government to implement budgetary requirements.

The Text of the 34th Amendment

Section 1. Limits to Personal Wealth and Income

To prevent concentrated economic power and the limitless dangers it presents to democracy, society, and the people, no individual shall be allowed to have a net worth greater than a hundred times (100x) the average national individual net worth, nor allowed to have a gross personal income greater than a hundred times (100x) the average national gross personal income. Persons with a worth or income exceeding these limits shall, (a) in the case of net worth, be subject to fines amounting to the current cash value of their wealth beyond the limit, or (b) in the case of income, be subject to fines in the amount of income beyond the limit. Second offenses incur higher penalties.

Section 2. Limits and Exclusions of Wealth and Property

Individual net worth in this Amendment shall be defined as an individual’s assets less liabilities. Taxable assets of an individual shall include: (a) financial assets (e.g., investor shares/stocks, bonds, etc.; values are based on the last trading day of the calendar year or last quarterly average, whichever is greater); (b) real estate; (c) trusts, foundations, and endowments; (d) cash accounts; (e) cash deposits; (f) accounts receivable; (g) savings accounts; (h) commodities in stock amounts beyond personal use; (i) collectibles and luxury items; (j) digital/virtual assets; (h) personal loans exceeding the average annual federal gross individual income; and (i) any other forms of wealth according to legislation that do not contradict this Section.

Taxable assets shall exclude: (a) worker-owned shares before redemption/withdrawal; (b) business assets (that is, assets in use or owned by the business of a sole-proprietor, contractor, partnership, or firm); (c) personal possessions, such as one’s clothing, wearables, household items, primary vehicle, or similar items; (d) Personal Emergency Fund (PEF) which is a non-taxable, non-interest-bearing cash account amounting to no more than half the average annual federal individual income and is limited to one withdrawal every three (3) years; (e) Federal Retirement Account (FRA), which is a non-taxable, long-term savings account that may not exceed twelve times (12x) the annual average personal income at the time of maturity, and may not be withdrawn/redeemed until after age sixty (60), except for cases involving terminal illness or permanent disability, wherein funds may be withdrawn/redeemed before reaching retirement age.

Section 3. Limits to Re-Allocating Personal Wealth and Income

It is prohibited for individuals to avoid the effects of the limits in Sections 1 and 2 by using company assets for their personal use, using shell companies, spurious names or entities, trusts or foundations, offshore tax havens, laundering money, or conducting other such evasions. Any citizen or permanent resident that allocates or systematically transfers more than half of their wealth or their company’s wealth (or their company’s company’s wealth…) to accounts not located in the United States for any reason other than establishing foreign residence shall be liable for violating this Section.

Section 4. Limits to Housing Ownership and Estates

To prevent concentrations of real estate and housing power in the hands of a small minority of private entities, no entity or conglomerate of entities may own more than six (6) dwelling units—such as an apartment unit or single-family residential home—in any given time or place, whether for rent or for their own personal use. Furthermore, residential absentee landlording, wherein a landlord hires the equivalent of at least one (1) full-time worker to physically manage residential property(s) on the landlord’s behalf, is prohibited. Tenant-owned housing/apartments may issue up to forty percent (40%) of their equity to investors; no person or conglomerate may own more than forty percent (40%) of any such tenant-owned housing property(s). Private estates for dwelling shall be limited to ten (10) hectares; estates exceeding this area limit shall be used for agricultural purposes, or subdivided by local governments, and/or designated wildlife preserves under the jurisdiction and care of local government. Hotels, vacation-homes, and other temporary housing units that do not host permanent residents are exempt from the equity requirements of this Section.

Section 5. Limits to Endowments

University endowment amounts exceeding ten times (10x) the average university endowment shall annually be transferred to the poorest universities in the country by the end of the fiscal year.

Section 6. Limits to Hazardous and Socially-Harmful Financial Institutions

All private equity firms, hedge funds, shadow banks, pyramid schemes, Ponzi schemes and other financial scams or capital-consolidating schemes shall be prohibited.

Section 7. Limits to Hazardous and Socially-Harmful Financial Investments and Practices

Stocks (of MOFs), bonds, cash deposits, interest-yielding savings accounts, real estate and rental property (within the limits of this Amendment and pursuant legislation) and other such forms of investments shall be lawful. Non-MOF stocks, as well as options, derivatives, structured investment vehicles (SIV), credit-default swaps (CDS), exchange-traded funds (EFT), commodity futures, foreign exchange (forex), high-yield junk bonds, day-trading, insider-trading, margin-trading, digital currency presales and pre-ICOs, and other financial instruments and activities characterized by significant risk, volatility, speculation, and non-productivity in the real economy, shall be prohibited.

Section 8. Limits to Borrowing, Lending, and Interest

It is prohibited for any entity to (a) borrow more than three times (3x) their net worth; (b) lend more than three times (3x) their net worth; (c) charge compound interest of any amount; (d) charge more than twelve percent (12%) annually on any loan; and (e) issue, sign, or establish a financial contract or loan that exceeds thirty-six (36) years, whether foreign or domestic. Furthermore, individuals shall have the right to seek bankruptcy relief, with laws ensuring fairness between debtors and creditors, and preventing exploitation and financial servitude of all parties. Furthermore, to avoid both economic instability and exploitation, no lending institution shall establish a reserve ratio of less than one to three (1:3, or 33⅓%), and no interest rate between any entity or group of entities shall fall below 0% or exceed 12%.

Section 9. Limits to Intellectual Property

The following intellectual property rights shall be recognized: (a) one to six (1-6)-year patents on utility or design; (b) one to three (1-3) year copyrights; (c) Creative Commons Licensure (CC BY, CC BY-SA, CC BY-NC, CC BY-ND, CC BY-NC-SA, or CC BY-NC-ND). Additional intellectual property rights are not recognized unless passed through legislation pursuant of this Amendment, which must prioritize the collective interest, ethical considerations, and equitable access to knowledge over private financial benefits.

Section 10. Monetary System

Unless otherwise determined by a two-thirds (2/3) vote of both the Executive Board and the People’s House, the United States shall establish and maintain a unified monetary system with a single national currency, the dollar ($). All governments must use the dollar for domestic transactions and collection of taxes. The use of alternative currencies and digital tokens may be permitted on a limited basis as determined by legislation. Credit unions and cooperative banks shall establish a 21-seat Democratic Monetary Council (DMC), consisting of representatives elected by federally-chartered credit unions or cooperative banks. The DMC shall be authorized and responsible for formulating and implementing monetary policy, creating money and regulating the money supply, setting interest rates, and shall operate according to the American Institute of Parliamentarians Standard Code (AIPSC2) and moderated by an independent parliamentarian. Its decisions shall prioritize (a) economic stability, (b) price stability, (c) low inflation, (d) financial security, (e) economic and financial equity, (f) sustainable development, and, only in the rare occasion of war, to prioritize (g) national security and military defenses. The DMC’s issuance of currency shall be by fiat and enter the economy through member bank reserves and/or direct deposits into FRA and PEF accounts, and shall be issued solely to achieve the priorities above (a-g). Each DMC Member shall be elected every two (2) years by the People’s House from a pool of three (3) candidates put forward by the largest credit unions and cooperative banks in the country. If possible, none of the twenty-one (21) members shall be from the same state. Members shall serve non-renewable staggered six (6) terms. DMC members may be removed by a two-thirds 2/3 vote of the DMC, the Executive Board, the People’s House, or the Supreme Court for violation of bylaws policy, this Constitution, or any other official law. The DMC shall conduct regular and transparent reviews of its policies, with opportunities for public input and shall submit an annual report to the People’s House and Executive Board, detailing its decisions and the rationale behind them.

Section 11. Budgetary Requirements

A joint Budget Committee of the House and Executive Board shall be responsible for establishing and updating quarterly, annual, and six (6) year budgets for the Federal Government. The Budget Committee shall number between eleven (11) and twenty-one (21) persons with at least three (3) members from the Democratic Monetary Council. A People’s House that fails to achieve a balanced budget at the end of a six (6) year fiscal budgetary period shall be dissolved, followed by new elections for office within sixty (60) days.

Section 12. Implementation Schedule

This Amendment shall come into effect sixty (60) days after approval, which the exception of Section 10, which shall replace the Federal Reserve System over a period of three (3) years, with the 1:3 reserve ratio coming into effect no later than twelve (12) years after approval. Furthermore, for landlords who own more than six (6) dwelling units after this Amendment comes into effect, sixty percent (60%) of their total equity shall be automatically transferred/reallocated to tenants when the Amendment comes into effect in order to comply with the equity limitations in Section 4.